Top 3 Cryptocurrencies to Consider for Your 2023 Portfolio

Written on

Chapter 1: Introduction to Cryptocurrency Investments

When it comes to investing in cryptocurrencies, understanding the potential demand for a specific network is crucial. This principle applies to all forms of investment, as you're essentially betting on future prospects.

Before diving in, it's vital to conduct in-depth research and assess your options meticulously. In this article, I will spotlight three cryptocurrencies that I believe could lead the industry. Although two have gained significant traction, the third remains a topic of debate.

Please note that this is not financial advice; always do your own homework before making investment choices. If you're thinking about integrating cryptocurrency into your portfolio, consider a small, diverse selection of established options to spread your risk.

Section 1.1: Recommended Cryptocurrencies

The three cryptocurrencies worth exploring include:

- Ethereum — Proof of Stake

- Bitcoin — Proof of Work

- Solana — Proof of History

Ethereum is a proof-of-stake cryptocurrency that has gained popularity for its smart contract capabilities. On the other hand, Bitcoin is a well-established proof-of-work cryptocurrency, known for its reliability and robust security. Lastly, Solana, utilizing a proof-of-history mechanism, has carved out a niche in the NFT market, demonstrating adoption patterns akin to Ethereum.

Despite facing criticism for my stance on Solana in a previous post, I'm firm in my belief. Its zero transaction fees and impressive NFT market performance indicate its potential for future growth, especially during its adoption phase.

Chapter 2: Bitcoin — The Pioneering Cryptocurrency

To begin with the least contentious option, Bitcoin stands as a decentralized digital currency employing cryptographic security measures. Created in 2008 by the enigmatic Satoshi Nakamoto, it has become the most recognized cryptocurrency by market capitalization.

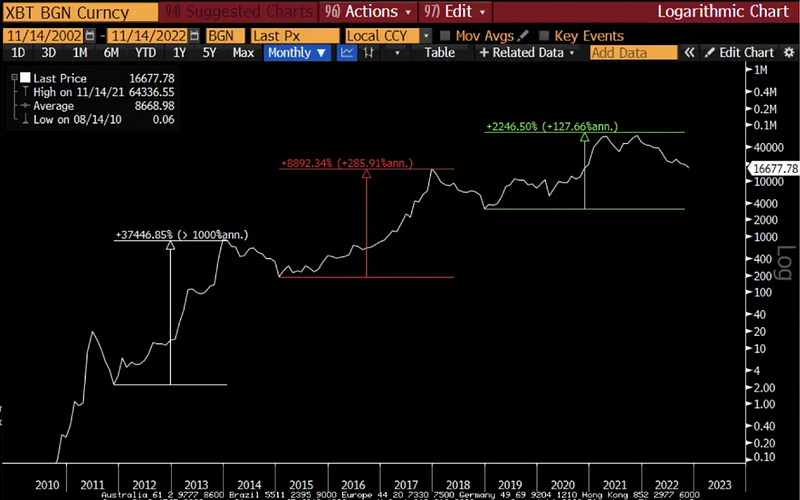

Despite its popularity, Bitcoin has been criticized for its significant energy consumption during mining processes, which reportedly exceeds the energy usage of Argentina, a country with around 45 million inhabitants. Nonetheless, Bitcoin has achieved widespread acceptance and has been the top-performing asset over the past decade, outperforming traditional stock markets.

According to a Goldman Sachs report, Bitcoin is likely to continue competing with gold for market share as digital assets gain traction. The report highlights Bitcoin's market cap of $316 billion compared to gold's $2.6 trillion, suggesting that Bitcoin holds a 12.5% share of the "store of value" market. If trends continue, predictions indicate Bitcoin may surpass gold by 2030.

Section 2.1: Ethereum — The Smart Contract Revolution

Ethereum operates as a decentralized platform enabling smart contracts—applications that execute precisely as programmed, free from downtime or third-party interference. Written in Solidity, Ethereum's smart contracts have the potential to transform business and value exchange.

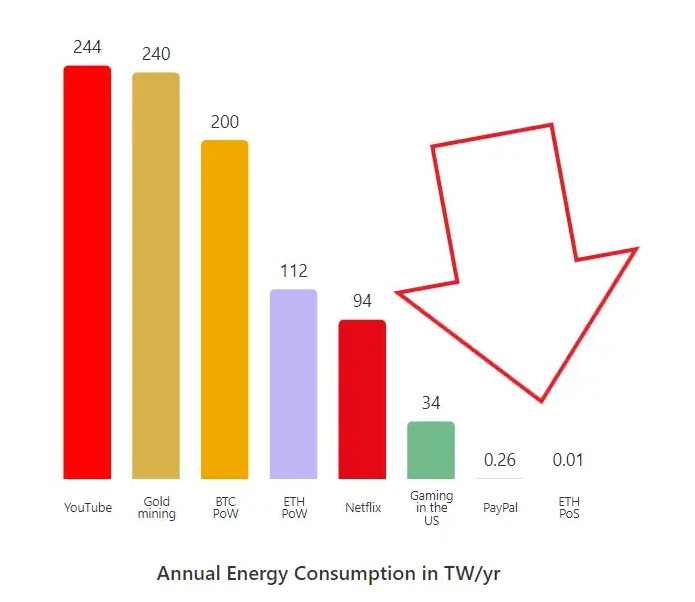

Often dubbed "internet money," Ethereum has garnered acclaim for its smart contract capabilities, compared by business leaders to the revolutionary impact of the printing press. Recent improvements, including a successful merge event, have enhanced Ethereum's energy efficiency by 99.5%, making it less energy-intensive than popular streaming platforms.

Section 2.2: Solana — The High-Performance Blockchain

Solana is a cutting-edge blockchain platform capable of processing up to 65,000 transactions per second at minimal costs. As of September 2022, it has successfully handled over 100 billion transactions at an average cost of just $0.00025. Its proof-of-history mechanism ensures that every transaction is recorded and verified, enhancing reliability and efficiency.

Compared to Bitcoin and Ethereum, Solana offers superior speed, likened to Visa's transaction capabilities. It has recently gained traction against Ethereum due to its lower fees. Co-founded by tech veteran Anatoly Yakovenko, Solana attracts investors thanks to its smaller market cap, presenting significant growth potential.

Active development is crucial for any cryptocurrency’s future, and Solana boasts around 1,000 monthly active developers, compared to Ethereum's 4,000 and Bitcoin's 500. This vibrant developer community is pivotal to mainstream adoption.

Video Description: Dive into the best $1500 cryptocurrency portfolio for 2024, exploring strategic investments and insights to maximize returns.

Video Description: Discover the details of my 2023 cryptocurrency portfolio that has proven successful, along with the reasons behind each choice.

Final Thoughts

Investing in cryptocurrency involves speculation about future network demand. It's essential to evaluate your options thoroughly before making investment decisions. The three cryptocurrencies I recommend for consideration are:

- Ethereum, known for its smart contract functionality.

- Bitcoin, a reliable cryptocurrency with a solid track record.

- Solana, a high-speed blockchain with growing market presence.

Each cryptocurrency has its unique features and risks, which should be weighed carefully. Please share in the comments if you believe there are other cryptocurrencies worth mentioning. If you're interested in more insights on Web3, consider joining as a member; your support helps sustain the writers you enjoy. For significant financial decisions, consulting a financial professional is advised.

Subscribe to DDIntel Here.