Bitcoin Market Volatility: Understanding Recent Fluctuations

Written on

Chapter 1: Market Turbulence and Reactions

The cryptocurrency market has recently experienced significant upheaval, with some coins witnessing losses of up to 50% within mere hours.

Bitcoin's value has dipped by 18%, settling around $47,500, while Ethereum and other altcoins faced even steeper declines, averaging around 20%. This widespread sentiment of an impending sell-off triggered a bearish trend, resulting in a series of cascading effects across the market. Interestingly, Bitcoin's dominance has not diminished; in fact, it has grown during this correction phase, as lesser-known altcoins with smaller market caps lost substantial ground. Some of these alternative cryptocurrencies plummeted by as much as 60-70% in just one day. In this context, it’s essential to view these coins not merely as investments but as high-risk speculations—great rewards can lead to severe losses for those unprepared.

Chapter 2: Bitcoin's Resilience Amid Market Corrections

The long-term narrative surrounding Bitcoin remains intact despite recent fluctuations.

The initial excitement surrounding the launch of North America's first Bitcoin ETF, the Purpose Bitcoin ETF, resulted in Bitcoin's market capitalization exceeding $1 trillion for the first time. With Bitcoin's price surpassing $53,000, it achieved one of its most significant milestones since its inception, an achievement that was unimaginable just a year prior. Prominent figures like Elon Musk and rising inflation fears have propelled BTC's price closer to $60,000. Additionally, strategic moves by global central banks to stabilize an economy on the brink of crisis, coupled with zero interest rates and the involvement of major companies like PayPal and Mastercard, have further fueled Bitcoin's popularity.

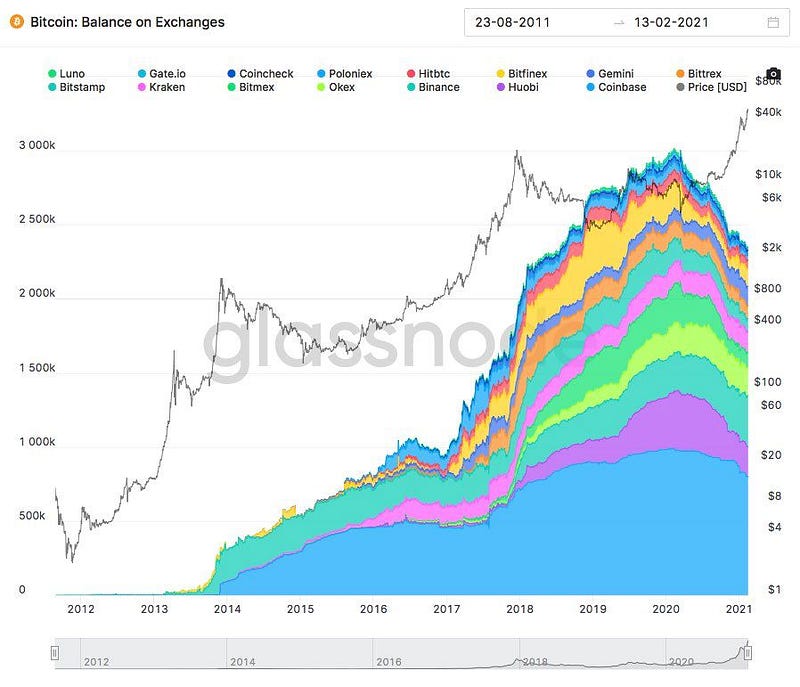

As investors, both institutional and individual, hold onto their digital assets, exchanges are experiencing unprecedented liquidity challenges. The ongoing decrease in the circulating supply of Bitcoin is contributing to its increasing value. For the first time, we are dealing with a finite asset where the price is less important overall. In the near term, Bitcoin's value is likely to be dictated by speculative trading aimed at future resale at higher prices due to its scarcity. If Bitcoin can secure a fiduciary role in daily life, its true potential may emerge, supported by Layer 2 protocols like the Lightning Network and RSK.

Chapter 3: Anticipating Future Trends

The recent market correction should be viewed as a natural adjustment following an extended rally that has lasted over a year. This phase allows investors to accumulate assets at lower prices. The cryptocurrency market remains volatile, presenting risks not only for retail investors but also for larger institutional players. Although this recent downturn cannot strictly be classified as a crash, the warning signs were evident, and a correction was inevitable.

When investing in cryptocurrencies, a medium to long-term perspective is essential, focusing on protocols that provide genuine value to the ecosystem. These corrections can redirect capital from less valuable projects toward platforms that advance the entire market.

Join the Coinmonks Telegram group to learn more about crypto trading and investing, and explore various resources to enhance your understanding of the crypto landscape.